Deferred revenue is a key consideration for companies operating through business models grounded in recurring revenues. Depending on contract terms, payments may be collected periodically or in lump sums. For companies that recognize annual renewals as revenue at the time of collection, deferred revenue analysis helps distinguish between true accrued revenue and contractual obligations the company is liable for. This often leads to diligence adjustments to revenue and can often reveal off balance sheet liabilities. Given its high focal point during diligence, it’s important for both buyers and sellers to be aware of deferred revenue and what this means for negotiations. For buyers, deferred revenue analysis provides insight to accrual-based revenue and adjusted EBITDA. For sellers, a deferred revenue analysis facilitates early discussions on these adjustments and prepares the seller for negotiations.

What Role Does Deferred Revenue Play in Financial Due Diligence?

The need for deferred revenue analysis arises from the fact that the business may receive consideration before it fully performs its obligations under contract. Under IFRS 15, companies must follow these steps1:

- Identify the contract with the customer – These are legally enforceable contracts with rights and obligations.

- Identify the performance obligations in the contract – Performance obligations are promises in a contract to transfer goods to a customer or to perform agreed upon services. There may be multiple performance obligations in a contract.

- Determine the transaction price – This is the consideration expected in exchange for the goods or services. This amount could be variable (i.e., due to volume discounts or other contingent factors).

- Allocate the transaction price to the performance obligations – Each performance obligation should have a transaction price.

- Recognize revenue when (or as) performance obligations are satisfied – A performance obligation is satisfied by transferring a promised good or service to a customer. For performance obligations satisfied over time, the company would select an appropriate measurement of progress to determine how much revenue should be recognized as the performance obligation is satisfied.

For companies under US GAAP, ASC 606 offers a nearly identical revenue recognition framework. Due to this, payments received in advance need to be recorded as a contract liability, or deferred revenue, until the performance obligation is met. When companies don’t report deferred revenue, or under report it, this analysis identifies contractual liabilities that are not reported under cash-based reporting and aligns adjusted sales with IFRS 15 or ASC 606.

How Do You Perform a Deferred Revenue Analysis?

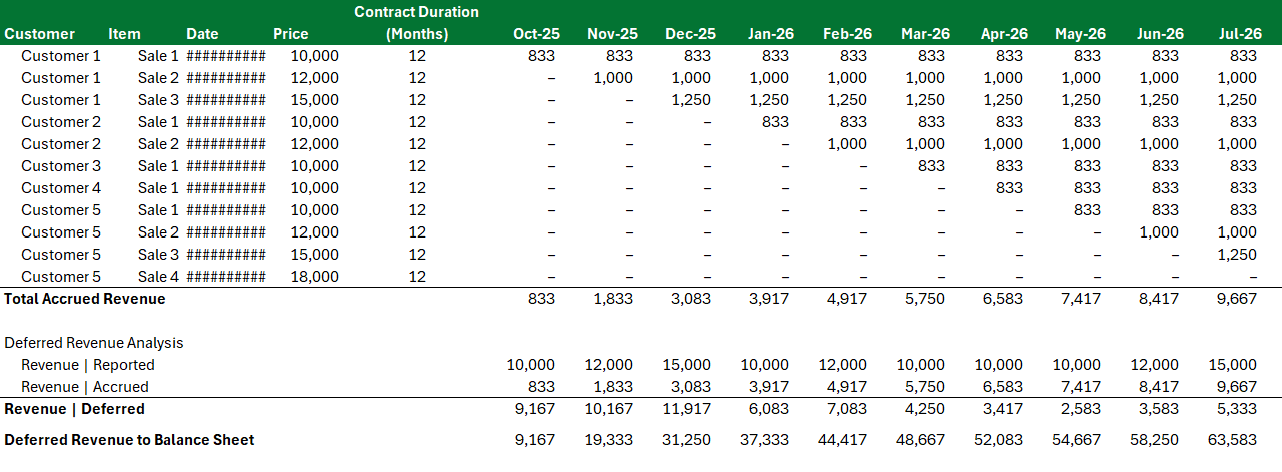

The first and most important step in the analysis is collecting the correct data. To correctly calculate the revenue waterfall, a comprehensive revenue report is required. This report will need to identify recurring vs. non-recurring revenue, or these will need to be manually identified and excluded from the analysis. Subsequently, revenue is accrued over the life of the contract, depending on when each performance obligation is met. This could be based on achievement of certain milestones or in equal installments. This process is repeated for each revenue transaction in the diligence period, and the columns are tallied up for each month. The difference between total restated accrued revenue and reported revenue is the deferred revenue adjustment that will flow to the balance sheet. For sellers, it’s important to understand that this analysis often leads to a downward revenue diligence adjustment because reported cash-based revenues overstate revenue and understate contractual liabilities which need to be satisfied post-close.

Exhibit A illustrates a simplified example of how the calculation would appear and where each balance ultimately flows.

Transaction Implications

From the buyer’s perspective, there is a risk of reported EBITDA being overstated prior to this adjustment leading to a higher valuation then what accrued revenues support. Additionally, liabilities would be understated as the company remains liable for fulfilling the performance obligations even though cash has already been collected. For this reason, buyers tend to view deferred revenue as a net debt item to be excluded from the working capital analysis. Sellers on the other hand tend to argue that deferred revenue is always going to be a part of the business. They often view it as a current liability item within net working capital, creating a common point of contention in transactions. Regardless of the final agreement between both parties, the adjusted P&L through a financial due diligence engagement will be more in line with IFRS standards and will provide a more solid foundation for negotiations.

Things To Look Out For

Below we list a few common themes to look out for when assessing deferred revenues to drive additional insights:

- Increased collections in the most recent months: companies may attempt to improve cash flow by increasing collection speed prior to the transaction, or having customers renew subscriptions early. This may improve cash-based reporting, but the deferred revenue analysis will rectify this with the additional collections being deferred and reclassified as a liability.

- Aging receivables may indicate slower collections and may even lead to greater collection risk where customer cease to pay their bill. This can often be pursued through a collections agency, though at a cost, and may take several months to complete.

- Existence of any uncollected deferred revenues. In some cases, the company may have billed large amounts upfront but have not been able to collect on it yet. This would also need to be adjusted for after a detailed analysis of the AR aging schedule.

- Analyze the monthly recurring revenue (“MRR”) and its trend. A growing MRR indicates the company is efficiently onboarding new customers or is upselling to existing customers providing a greater monthly cash flow.

- Revenue and customer retention and churn metrics, both on a gross and net basis. These KPIs help to measure customer trends and provide context to better understand the year-over-year performance.

Why Deferred Revenue Analysis Matters in Transactions?

In summary, deferred revenue analysis is crucial during the due diligence process when the target company collects payments upfront for services or goods to be delivered in the future. Adjustments are required to align the financials with accounting standards and the existing accounting policies of large strategic buyers who often report on an accrual basis and follow IFRS or US GAAP. There are different methods of calculating deferred revenue, so it is important to understand the nature of the contracts, their performance obligations, and select a method that best represents those contracts. Deferred revenue adjustments will have significant transaction implications so being aware is key for both sides to successfully close the transaction. It is best practice to partner with a third-party service provider to carry out an independent analysis of deferred revenue to avoid any bias in the conclusion.