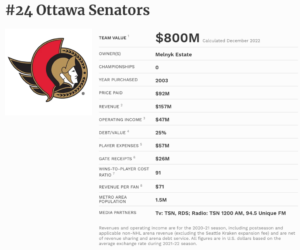

The Ottawa Senators are making headlines with reports suggesting that a group of high-profile celebrities, including The Weeknd, Snoop Dogg, and Ryan Reynolds, are interested in buying the team. This news comes as the Senators’ valuation is at an all-time high, with Forbes recently listing them at US$800 million (Dec 2022). Historically, the highest price paid for an NHL team was when LeBron James’ Fenway Sports Group bought the Pittsburgh Penguins in 2021 for US$900 million.

But how do we determine the appropriate price to be paid for the Senators?

There are a few different approaches to valuing a sports team, with the most common being Discounted Cash Flow (DCF) and the Comparable method, also including Market Value approach, Revenue Multiplier method and Brand Equity method, each with their own strengths and weaknesses. A thorough analysis of the team’s business, historical performance, and current market conditions will help to determine the most appropriate valuation method and valuation.

Common valuation methodologies

The DCF approach involves estimating the team’s future cash flows and discounting them back to their present value, thus arriving at a total value for the team as of the valuation date. This approach requires a good understanding of the team’s business, including its revenue streams and expenses, as well as any scenarios that could impact the team’s future performance.

The Comparable method involves looking at the prices paid for similar scale of operations in the past and using that information to arrive at a reasonable valuation. This method requires identifying similar teams, determining the factors that influenced their valuations, and adjusting for any differences between the current transaction and the identified comparable transaction.

The Brand equity method considers the intangible value associated with a sports team’s brand. It recognizes that a team’s brand can have a significant impact on its financial performance, market positioning, and overall value. Certain typical factors considered under this method are customer base, market reach, sponsorship/ equity, media presence, reputation, relationships and historical performance.

General valuation process with example

Regardless of the method used, there are certain steps that should be followed in any valuation process. These include understanding the business, developing forecasts and assumptions about future performance, applying the chosen valuation method, and giving effect to any unusual items that could impact the team’s value.

DCF

To illustrate the valuation process, let’s take a look at a case review of a hockey team. In this example, we’ll use the DCF approach to value the team.

First, we would need to understand the team’s business. This would involve analyzing the team’s revenue streams, including ticket sales, merchandise sales, and sponsorships, as well as its expenses, including player salaries, arena costs, and front office expenses.

Next, we would develop forecasts and assumptions about the team’s future performance. This could involve looking at historical data and trends, as well as considering factors such as the team’s current roster, coaching staff, and any potential changes to the league’s rules or economic conditions.

Once we have developed our forecasts and assumptions, we would apply the DCF method to estimate the team’s future cash flows and discount them back to their present value. This would involve calculating the team’s expected revenues and expenses over a set period, such as five years, and then discounting those cash flows back to their present value using an appropriate discount rate.

Finally, we would give effect to any unusual items that could impact the team’s value, such as significant investments in new facilities or changes to the league’s revenue-sharing structure. In case of the Senator, one such instance are the plans of building a new arena for the team at LeBreton Flats; expected capital costs for this purpose would need to be given effect to, during the valuation process, along with corresponding revenue projections.

Comparable Transaction

Let’s say we want to value an NHL team based on the prices paid for similar teams in the past. We could start by looking at recent sales of NHL teams and their sale prices.

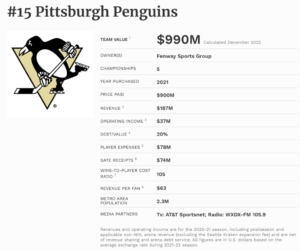

For example, the Pittsburgh Penguins were sold in 2021 for around $900 million to LeBron James’ Fenway Sports Group. The team had a strong track record of success, including the success with Stanley Cup championships, high viewership and television ratings, and was located in a mid-sized market with a passionate fan base.

To use this sale as a basis for valuing the Senators, we would need to identify the key factors that influenced the Penguins’ valuation, such as their revenue streams, market size, and historical performance. We would also need to adjust for any differences between our team and the Penguins, such as differences in location, fan base, or arena quality. Assuming the Senators is in a mid-sized market, has a similar revenue mix, and a history of consistent performance, we might use a similar Revenue or EBITDA multiple to arrive at a present valuation.

However, it’s important to note that the sale of the Penguins was an outlier and may not be representative of the valuations of other NHL teams. The Penguins had a unique combination of on-ice success, market size, and ownership appeal that drove up their sale price. As such, it’s important to conduct a thorough analysis of the team’s business, historical performance, and current market conditions before arriving at a final valuation.

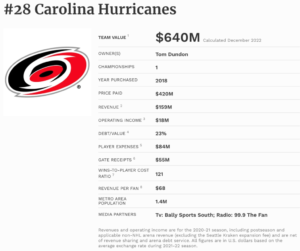

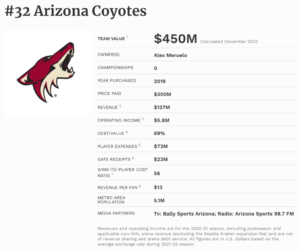

For example, in 2018-19, the Carolina Hurricanes were sold for ~$400 million, while the Arizona Coyotes were sold for $300 million. We could use these sales as a basis for valuing the Senators.

To do so, we would need to identify the key factors that influenced the valuations of these teams, such as their market size, revenue streams, and historical performance. We would also need to adjust for any differences between our team and the teams that were sold, such as differences in location, fan base, or arena quality.

The Carolina Hurricanes might provide a closer benchmark for the Senators, considering several important factors such as revenues, gate receipts, win ratio, and per fan revenues. Upon comparison, the Senators exceeds the operating income benchmark set by the Hurricanes, suggesting a potential higher valuation. Taking the Carolina Hurricanes’ valuation as a starting point, we can consider this as a baseline for the valuation of the Senators. However, it’s essential to account for other distinguishing factors specific to the Senators.

Factors such as the Senators’ market size, historical performance, and potential for revenue growth should be given due consideration. These elements, among others, can impact the team’s overall valuation. Additionally, any unique aspects of the Senators, such as their fan base loyalty and the potential for revenue increase through a move to a new downtown arena, should also be factored into the valuation.

Here are some of the key information for the teams discussed above: 1

Figure 1 – Key Information on The Business of Hockey

Comparable Transaction

Continuing the case review, when it comes to the Senators’ brand value, factors such as their dedicated fan base, market reach, sponsorships, media presence, historical performance, and reputation contribute to its brand equity. Some of the key factors to be considered for this team are its revenues and operating income growth, major brand-name sponsors and the discussions relating to building a new arena. By considering these elements and conducting market research, a comprehensive assessment of the Senators’ brand value can be incorporated into their overall team valuation.

It’s important to note that brand valuation is subjective and influenced by various factors. Engaging branding experts and conducting thorough research ensures a more accurate evaluation of the Ottawa Senators’ brand equity within the context of their overall value.

While valuing a sports team, or any business for that matter, can be a complex process, by following a consistent methodology and taking into account all relevant factors, we can arrive at a reasonable valuation. It will be interesting to see who ends up buying the Senator and what price they ultimately pay, but one thing is for sure – it won’t come cheap.