In early October, Sapling presented a two-part webinar series on Financial Due Diligence in Uncertain Market Conditions. Here are the summaries:

Trend in the M&A Environment

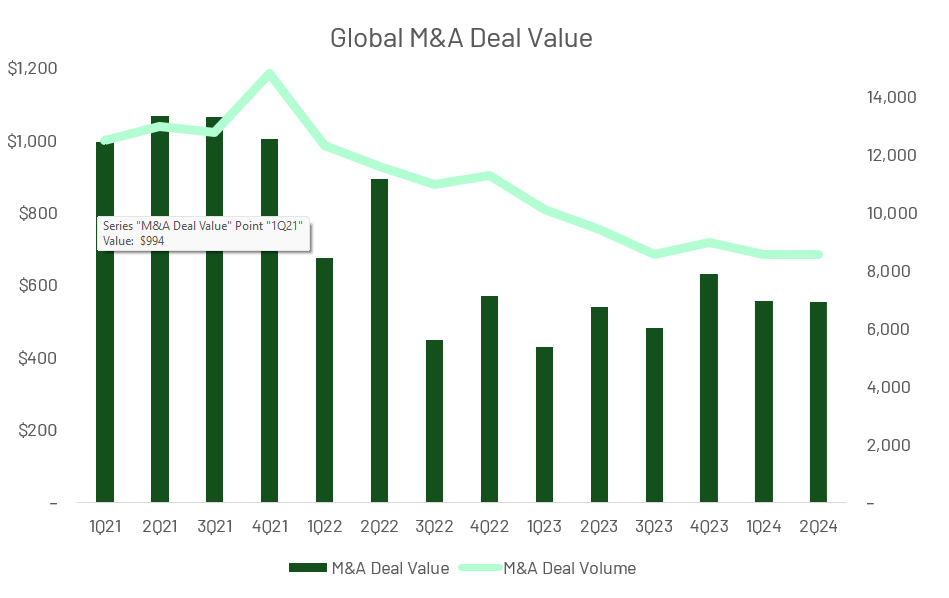

With the market rebounding, global M&A deal values for the first half of 2024 have increased compared to the same period last year, but they remain below the peak levels of 2021. Meanwhile, M&A deal volume continues its steady decline since 4Q2021 peak.

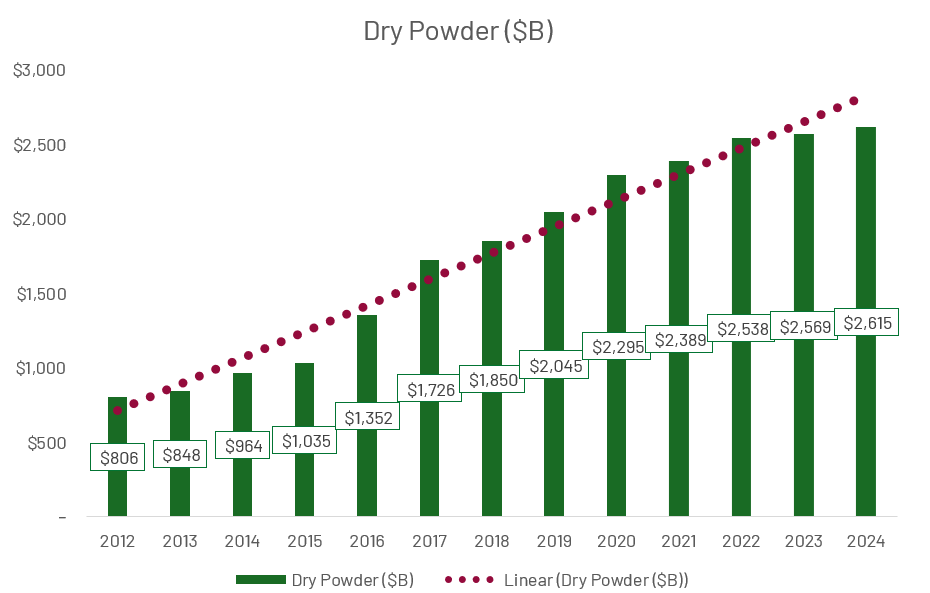

Additionally, private equity (PE) and venture capital (VC) firms hold a record $2.62 trillion in dry powder as of July 2024[1]. North- American PE firms continue to be a leading force in M&A activity, currently holding 63% of the global dry powder with most of the dry powder concentrated in the top-firms. In contrast, smaller firms are experiencing a six-year low in fundraising.

An interest rate-cutting cycle began in September 2024, boosting buyers’ capacity to acquire assets through cheaper debt financing. On the sell side, easing monetary policy increases market demand by supporting higher valuations. Sapling anticipate an additional rate cut by December 2025, aiming for a target range of 3.75%-4%[2] and expect more M&A activities in the market.

At Sapling Financial Consultants, we are experienced in working in financial due diligence engagements in both the sell-side and buy-side, to help our clients identify potential risk, make informed decision, and maximize value throughout the due diligence process.

Sell Side Financial Due Diligence

The objective of a sell-side financial due diligence engagement is to bring clarity and transparency to the seller’s financials, giving buyers the confidence to proceed with the deal. Due diligence is critical for sellers because it prepares them to address potential buyer inquiries and provides standard responses to key questions, strengthening both parties’ confidence in the valuation and accelerating the deal process.

At Sapling, our due diligence process typically includes:

- Interim financial statements preparation including financial statements reconciliation

- Quality of Earnings (QoE) analysis including EBIDTA adjustments

- Working capital review

- Debt and capital structure analysis

- Revenue and margin analysis including sales verification

- Cumulative Operating Cash Flow (OCF) to Cumulative EBITDA comparisons

- CapEx and future investment reviews

- Employee compensation and benefits examination

- Forecasts and projections

- Risk identification including financial and operational risks.

During the risk identification process, Sapling focuses on both financial and operational risks. This includes reconciling and validating the accuracy of the company’s financial statements, disclosing any liabilities such as debts or tax issues, and identifying irregularities in cash flow. Additionally, Sapling analyzes the business to uncover inefficiencies in operations and potential vulnerabilities within the supply chain.

Our team aims to identify risks early, helping sellers proactively address issues or prepare explanations before engaging with buyers. Ultimately, this approach strengthens the seller’s position, allowing them to present their business as a solid, reliable investment and facilitating a smoother transaction.

Buy Side Financial Due Diligence

In contrast, our buy-side financial due diligence focuses on validating the target business’s financial health and providing an objective overview of the company under consideration. In our buy-side QoE engagements, we delve into the typical processes found on the sell side but place particular emphasis on the following areas:

- Cash conversion ratios

- Proof of Profit and Loss (P&L)

- Sales verification

- EBITDA adjustments

This focus on the buy-side highlights the key aspects of due diligence that are crucial for potential buyers. By thoroughly assessing these elements, buyers gain a comprehensive understanding of the target company’s risks and can identify any areas of concern.

While there are additional items included in our scope, these areas represent the core of our buy-side work, where the value of the Quality of Earnings (QoE) analysis is most evident. By prioritizing these aspects, we empower buyers to make informed decisions, ultimately enhancing the success of their acquisitions.

The Importance of Neutral Third Parties in the Deal Process

Engaging experienced third-party professionals provides objective analysis and enhances the transaction for both parties. For sellers, professionals transparently showcase the company’s strengths, while for buyers, a skilled team ensures investment protection and alignment with both short- and long-term goals.

On either the buy or sell side, assembling a professional due diligence team improves credibility and trust, mitigates conflicts of interest, reduces deal risk, and increases transaction efficiency.

[1] S&P Global Market Intelligence. “Private Equity Dry Powder Growth Accelerated in H1 2024,” n.d. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-dry-powder-growth-accelerated-in-h1-2024-82385822.

[2] “CME FedWatch – CME Group,” n.d. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html.