A Microgrid is like a traditional power grid in that it is a group of interconnected sources and uses of energy, however, it differs in that it could operate completely independently of external connections. According to research conducted by Guidehouse in 2021, renewable microgrids will account for 500,000 new jobs, $72B USD in GDP growth, and $146B USD in sales by 20301. While microgrids have many benefits depending on their application and may be the most cost-effective option in many cases, there are significant barriers to financing such projects.

Strategic Benefits of a Microgrid

While sustainable and continuous energy access has significant economic and social advantages, the ability to “island” a microgrid carries additional benefits over a traditional grid. In the event of a disaster, microgrids typically stay operational due to their size and are faster and less complex to repair. Additionally, microgrids are highly customizable based on their local resource availability and use, such as by incorporating batteries or backup generation. Furthermore, microgrid projects often earn valuable tax credits, which boost the profitability of the project, depending on local laws and the type of energy being captured.

Challenges to Financing a Microgrid

Complexity of Revenue Streams: Uncertainty in project timelines, future energy prices, external energy demand, and energy generation volume makes it incredibly difficult to compute returns accurately. While tax credits act as incentives to capture renewable energy and strengthen returns, complexity is only increased from the perspective of the financier. Given the lack of a long-term track record of success and uniqueness of each microgrid project, investors typically don’t have enough conviction or experience valuing projects.

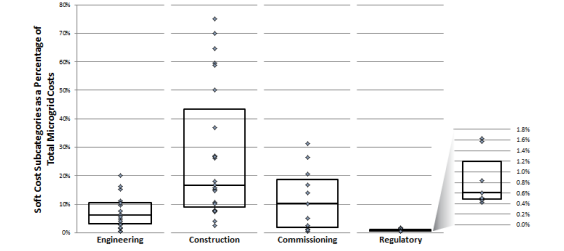

Cost Structure: As with revenues, costs associated with a microgrid are heavily dependent on the application. While estimating costs upfront is becoming more feasible as more projects are completed, there is still a massive amount of variance in total project cost, relating to the needs of the project, geographical region, type of energy being captured, and the number of existing assets being leveraged. Research from the National Renewable Energy Laboratory that was published in 2018 demonstrates this fact, where microgrid soft costs within the US range anywhere from 1% to 75% of total project costs (Figure 1).2

Figure 1) Soft Cost Subcategories as a Percentage of Total Microgrid Costs

Project Financing: Oftentimes, developers who offer a small equity investment, have little experience in microgrid projects, or have poor creditworthiness will have difficulty obtaining financing. Further, while the tax credits associated with these projects can be attractive if a party doesn’t have a tax appetite, they are less likely to take an equity position, as per insights from Microgrid Knowledge in 20203.

Overcoming challenges through bundling

Operational Risk: By combining similar projects in a portfolio, developers can realize efficiencies and economies of scale. Much of the design and other operational activities within these microgrid systems can be standardized, thus reducing soft costs, and decreasing perceived risk in subsequent projects for investors.

Financial Risk: Similarly, financial pooling for microgrid operations and growth allows multiple investors to increase their creditworthiness while reducing their transaction and operation costs due to standardization and economies of scale. Another common practice to reduce underlying energy price risk, especially with highly volatile commodities, is to leverage energy derivative financial instruments.

References:

- Wood, Elisa. “New Studies Point to Microgrids as ‘Once in a Generation Solution.” Microgrid Knowledge, 7 Nov. 2021, //www.microgridknowledge.com/editors-choice/article/11427591/new-studies-point-to-microgrids-as-8216once-in-a-generation-solution8217.

- Giraldez, Julieta, et al. “Phase I Microgrid Cost Study: Data Collection and Analysis of Microgrid Costs in the United States.” National Renewable Energy Labratory, Oct. 2018, //www.nrel.gov/docs/fy19osti/67821.pdf.

- Maloney, Peter. “How Financiers Think about Microgrid Project Funding.” Microgrid Knowledge, 25 Nov. 2020, //www.microgridknowledge.com/x-sub-features/article/11428459/how-financiers-think-about-microgrid-project-funding.