Often small businesses have ample of accounting anomalies such as personal expenses recorded in the books, cash basis of accounting, multiple one-time expenses, inaccurate assumptions, and so on. Quality of Earnings (“QoE”) reports help break down the components of financial statements and gives a drilled-down picture of financial performance and cash flows. Thus, it becomes an integral part of the due diligence process when buying or selling a small business

In this blog, we will understand what the meaning and purpose of a QoE report is.

What is QoE Report and what makes for high quality earnings?

Through rigorous financial analysis, a QoE report helps investors better understand a business’ historic earnings to better estimate future performance. The process involves analyzing the Income Statement, the Balance Sheet, and the Statement of Cash Flows, as well as discussions with management to adjust earnings for any non-recurring items. The use of QoE reports differs based on the purpose and requestor (buyer/seller) of the analysis. However, assumptions are always made avoiding bias to give an accurate view for both parties. Earnings are considered high-quality if they are repeatable and with relatively low accruals, meaning that the company isn’t relying on one-off items.

QoE analysis vs. Audit:

The purpose of a standard financial statement audit is to express an opinion on a company’s compliance with the relevant accounting standards. A QoE report on the other hand is meant to present a picture of what a company’s normalized earnings potential should be. The objective is to assess reasonability of the components of income. Accordingly, QoE reports are more forward looking compared to an audit which is based on the accuracy of historic financial statements. The process of analysing QoE is different from a detailed audit, as the focus of a QoE report is to determine economic earnings and provide flexibility in the approach. The most essential differentiator of a QoE analysis and an audit is the ‘normalizing adjustments’ to EBITDA.

Scope of procedures performed:

A QoE report consists of various procedures to reconcile the historical EBITDA components to the respective cash flows. Broadly, it consists of three main procedures viz. Reconciliations/Proofs, Trend Analysis, and Re-calculations.

Proof of Cash and Proof of Sales are the most frequently used parameters in a diligence process. These essentially play a role in corroborating the reasonability of the information per the books vis-à-vis the actual cash balances. Additionally, movements of Operating Cash Flows vis-à-vis EBITDA is beneficial to check if there are any significant non-cash charges included in Net Income.

Trend analysis is carried out for understanding the business-health through historic performance and can help illuminate any missing or unexplained variances that needs to be discussed and documented. It also helps in understanding the anomalies caused due to unusual variations temporarily affecting the financial performance, for example, the pandemic.

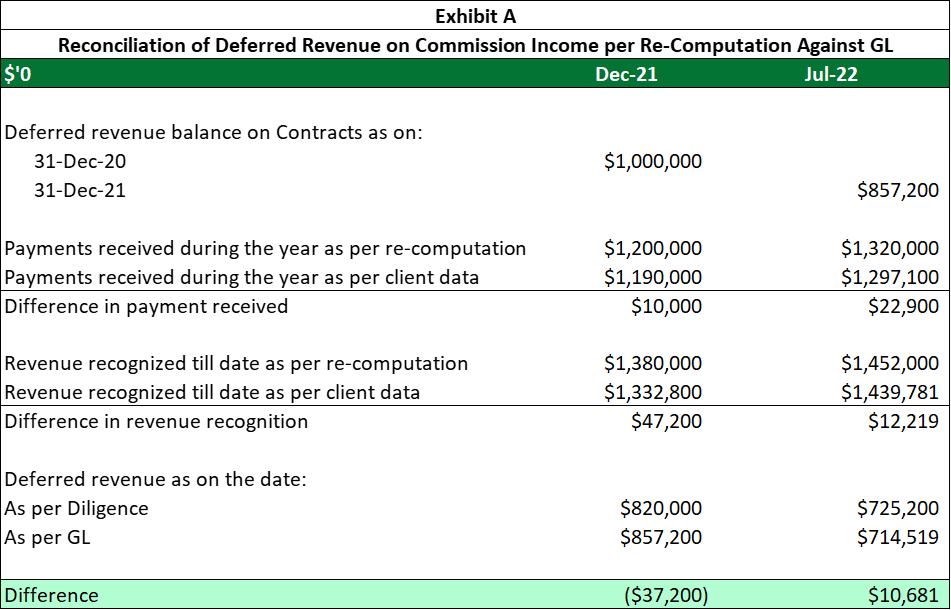

As an additional check for diligence, certain components that significantly affect the business, like revenues, direct costs etc., are re-computed to confirm the high-level range of the information recorded in the books and understand the reason behind any variances. Exhibit A below illustrates a re-computation exercise carried out as a part of diligence to reconcile deferred revenues recognized for two periods that shows the cause of variances is mainly a timing difference.

Why does EBITDA form the basis of the analysis?

The purpose of a QoE Report is to normalize the EBITDA that reflects the go-forward earnings of the business. It shows the results of business operations excluding management’s assumptions, capitalization decisions, and is net of tax variances arising between jurisdictions. Thus, when the EBITDA is used as a purchase price multiple, the deal value justifies the capabilities of the business in the foreseeable future.

Purposes and types of adjustments:

As a first step, the adjustments proposed by seller and the buyer are assessed in detail to confirm the appropriateness, in terms of reasonability and the period of analysis. Generally, these are in the form of non-recurring or personal expenses recorded in the books, or ay new expense projected going forward. Further, there might be adjustments per the diligence processes, that might have been missed or newly identified. Such adjustments are a result of reconciliations and re-calculations, depicted on a go-forward basis. In the case of certain businesses, testing the primary cost driver also plays a prominent role in assessing the go-forward situation, for example, labour cost analysis or commission expense analysis on projected basis.

A sample of adjustments made to EBITDA with certain illustrations of the types of adjustments are reflected in Exhibit B.