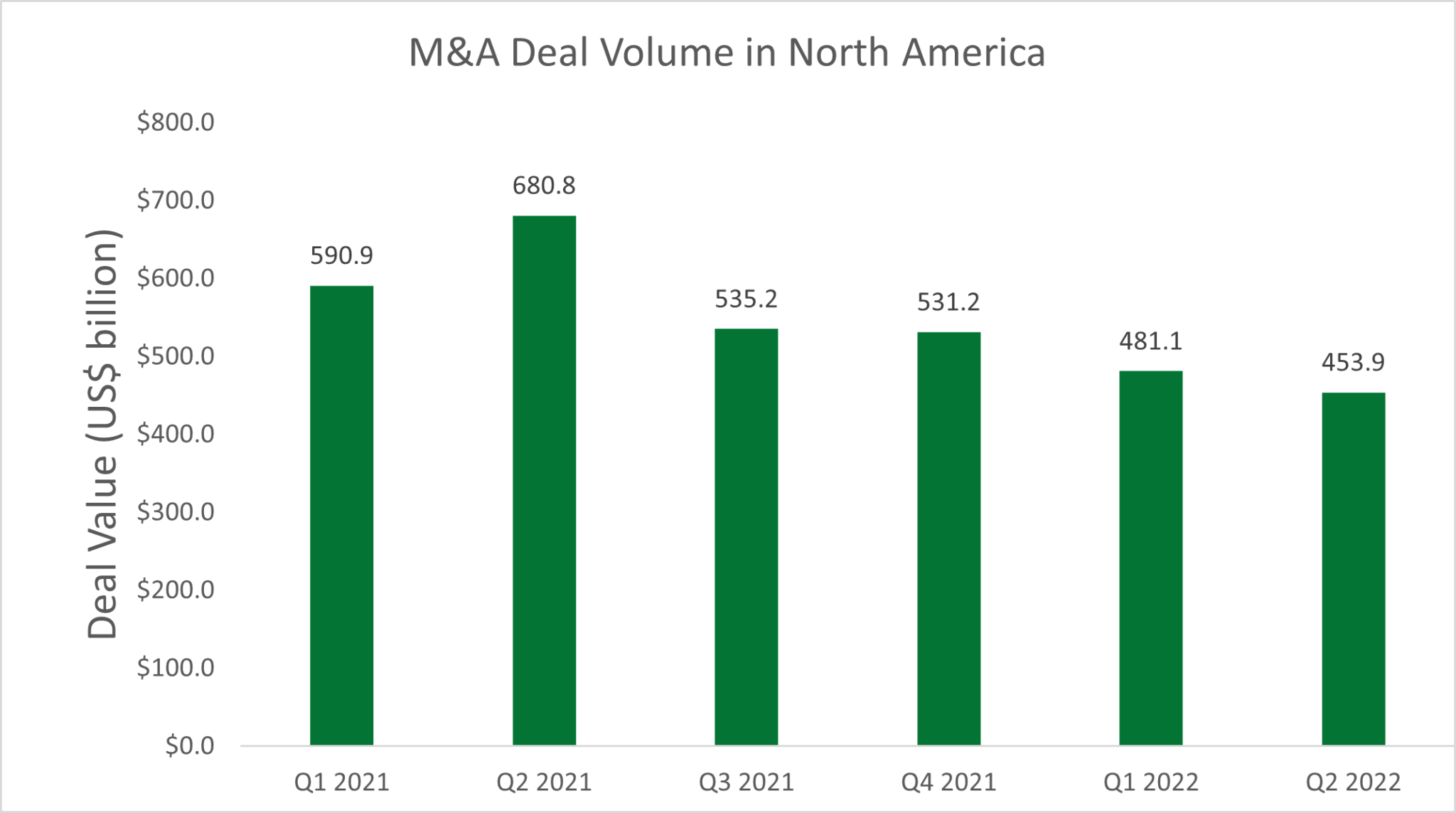

At the start of 2022, dealmakers expected the M&A market to thrive after overcoming the economic issues created by COVID during 2020 and 2021. In fact, 2022 has been affected by various geopolitical issues such as the Russia-Ukraine war, supply chain challenges and rising inflation and interest rates, all of which are expected to continue into Q4. Despite the uncertainty in the market, M&A deals remain relatively strong with Q1’2022 total deals worth $482.1bn North America, reflecting a drop from Q1’2021 record high ($590.1bn), while Q2’2022 deals were worth $453.8bn.

At the start of 2022, dealmakers expected the M&A market to thrive after overcoming the economic issues created by COVID during 2020 and 2021. In fact, 2022 has been affected by various geopolitical issues such as the Russia-Ukraine war, supply chain challenges and rising inflation and interest rates, all of which are expected to continue into Q4. Despite the uncertainty in the market, M&A deals remain relatively strong with Q1’2022 total deals worth $482.1bn North America, reflecting a drop from Q1’2021 record high ($590.1bn), while Q2’2022 deals were worth $453.8bn.

Regional Challenges, Geopolitical and Economic drivers

Dealmakers in North America see upside from rich technologies and market innovation, but uncertainty from the US political climate and regulatory situation represent headwinds. The US political climate driven by prioritizing raising corporate tax rates policy and M&A regulatory policies tightening to ensure fair competition between banks has affected private equity firms and strategic acquirors by causing an increased number of deals to avoid conflicting with regime signals of a restrictive mergers and acquisitions environment in the pipeline. It’s believed pursing digital transformation and closing deals prior to the tax and regulatory restrictions could add to deal momentum.

Furthermore, an increase in inflation rates (8.25% in August’22 vs 5.25% in August’21 in the US) has affected purchasing power as it led buyers to offer lower purchase prices and seek alternative forms of payment. The rises in inflation rates have affected the exclusivity period as well, allowing bidding companies to study target company pricing strategies and cost arrangements. In addition to the continuous rise in inflation rates since the start of 2022, interest rates increased by 200 basis points between January and August 2022 (from 0.25% to 2.5%) in both the US and Canada. The rise in interest rates is causing an increase in mixed payments offerings, blending cash and stock for deals, a trend which is expected to continue growing in popularity in Q4’2022.

There have also been concerns about whether the US is in recession, while rising wages and a booming labour market seem to indicate the contrary. However, the economic uncertainty and supply chain global challenges are affecting the M&A market as most companies are either allocating their funds to basic expenses or struggling to maintain sales and profits. This has the knock-on effect of limiting the number of companies on the auction block, as businesses await a return to health before beginning the sale process.

2022 M&A Market Trends

M&A activity comes from companies’ pursuit of growth strategy, amid high valuation and market volatility, we see trends with more businesses undertaking divestitures and spinoff transactions to optimize business portfolio and attract investors.

Technology industry continues to dominate the M&A transactions headed by North America region (mostly the US) making up to 83% of global tech M&A deals. Total technology industry cross border M&A deals in North America with a total worth of $5.9bn in Q2’2022.

The rise of environmental, social and corporate governance (ESG) investment is rapidly growing and becoming priority for regulatory and competitive reasons. As ESG performance has recently been incorporated in company valuation and risk assessment, it impacts potential transactions. Examples of ESG’s performance impacts are transaction due diligence processes in relation with corrupt businesses and shareholders and stakeholders concerns about ESG issues.

What’s To Come

Despite the headwinds experienced in 2022, M&A deals activity will remain as active as ever, however, dealmakers will have to adjust their strategies with the uncertain economy in mind with expectations that full year 2022 M&A will remain as strong but will fall short of record breaking 2021.

The biggest challenge expected is legal and regulatory issues other than policies such as environmental with tight ESG mandatory policies approaching.

Sources:

M&A Activity by value Q1 2019 – Q1 2022 (whitecase.com)

How the Current Economy Impacts Q3 and Q4 2022 M&A Market (devensoft.com)

The 2022 M&A Outlook for North America | Intralinks

Canadian M&A outlook for 2022 | Insights | Torys LLP

Record M&A boom risks running afoul of Biden’s antitrust cops – BNN Bloomberg

Canada Interest Rate 1990-2022 | FX Empire