Sapling Financial Consultants was delighted to facilitate an interactive webinar on April 1 to discuss the latest challenges posed by tariffs and how a Quality of Earnings (QoE) report can help during these turbulent times. Our Senior Engagement Manager, Kevin Zhao, shared valuable insights on the importance of QoE in any transaction and how to adapt the analysis specifically for tariffs. This blog highlights the significance of stress testing and offers guidance on how firms can tailor QoEs to navigate the impact of tariffs.

The Importance of QoEs

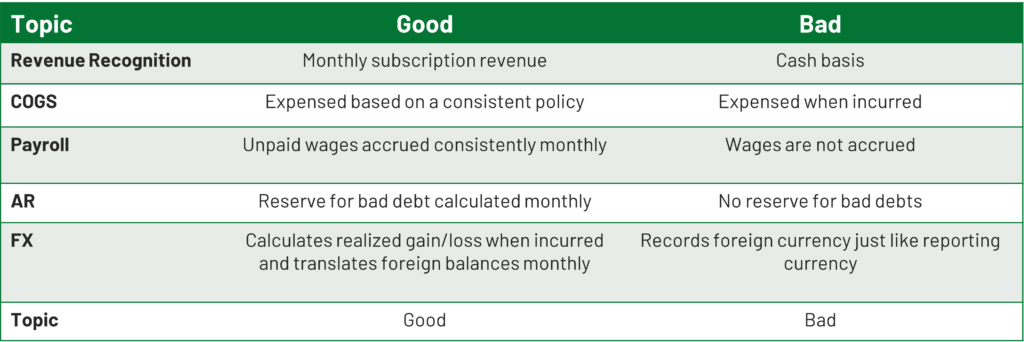

A QoE is crucial to understanding a business’s historical financial performance while eliminating other noise that may be masking the company’s true underlying performance. Quality in the QoE context refers to the degree to which earnings are cash, recurring and based on precise measurements. See Exhibit A for illustrative examples.

Exhibit A: Examples of Good and Bad Quality

- Deferred Revenue Analysis: A must-have for companies that collect revenues upfront for future services and record on a cash basis. Reported revenue on a cash basis versus accrual basis may differ significantly.

- Cash Proof Analysis: A must-have for non-audited companies to ensure EBITDA largely aligns with operating cash flows by adjusting for non-cash items on the P&L and cash items not reflected on the P&L.

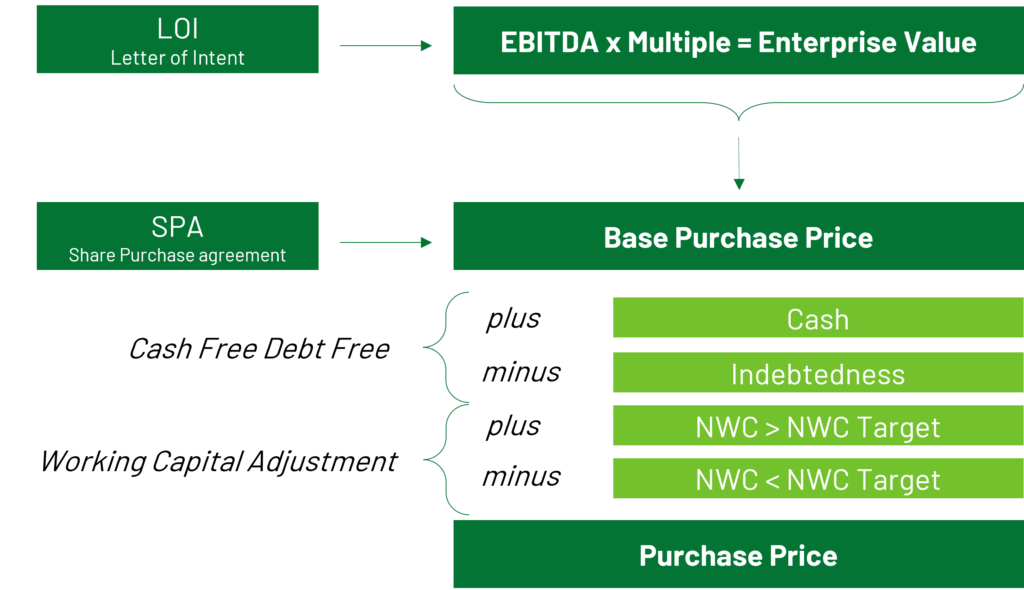

- Net Working Capital Analysis: Critical for all transactions to determine the right peg to set so that the seller leaves an appropriate level of working capital in the business prior to closing. Exhibit B illustrates how a typical purchase price adjustment formula is structured.

Exhibit B: Example of Purchase Price Adjustment Formula

Adapting to Tariffs

To mitigate the impact of tariffs, firms can implement several strategies:

- Stress Testing: Ensure that various tariff scenarios are included to assess the impact on revenue and EBITDA (e.g., loss of customers, increased costs, supply chain disruptions, and government subsidies).

- Reduce Customer Concentration: Analyze transaction-level sales data by customer and geography to determine concentration. Assess the feasibility of selling to new markets and reducing risk.

- Increase Liquidity: Analyze the balance sheet and trend current and quick ratios to determine a required level of liquidity. Apply an additional buffer as a dry powder reserve.

- Reduce Currency Risk: Analyze the company’s revenue and expenses by local currency and determine if there is a high concentration of foreign currency transactions. Employ hedging strategies if foreign currency concentration is deemed to be high.

How Stress Testing Can Help in the QoE Context

Stress testing is not only helpful for forecasts, but it can also help a potential buyer sensitize the target company’s historical performance and see how it fluctuates due to changes in key factors impacted by tariffs, such as the cost of goods sold. It can also help determine the impact of tariffs on working capital and how much potential cash reserves may be required in case of any shortfalls.

By understanding how tariffs might affect the company under diligence, buyers can make more informed decisions and prepare strategies to better adapt to changing circumstances.