Sapling Financials Consultants was pleased to lead an engaging webinar focused on the value provided by activity-based costing and its application in environments characterized by uncertain costs. Our Consultant, Tyler Grube, shared valuable insights into how managers can use Activity-Based Costing (“ABC”) models to make proactive business decisions, driving profitability in the face of tariffs. This blog post highlights the benefits of ABC and offers guidance on how firms can navigate the impacts of tariffs.

What is Activity-Based Costing?

Activity-Based Costing (“ABC”) is a cost accounting method that assigns overhead and indirect costs to the specific activities that drive them, rather than spreading costs evenly across all products or services. Unlike traditional costing methods, which often allocate overhead based on a single factor like labor hours or machine hours, ABC recognizes that different products, services, or customers consume resources in different ways.

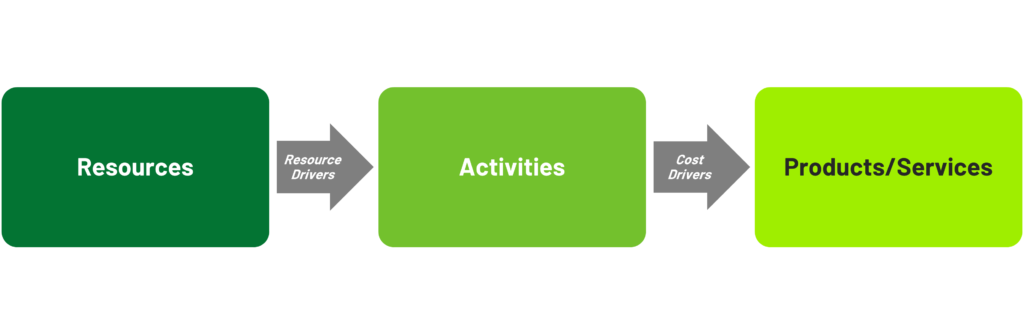

Exhibit 1: ABC Methodology

By identifying the activities involved in delivering a product or service—such as procurement, setup, customer service, or quality control, ABC allows organizations to more accurately trace costs to what’s driving them. This approach provides deeper insights into profitability, revealing which products or customers are truly contributing to or draining financial performance.

ABC is especially useful in complex or rapidly changing economic environments, where precision matters. It helps decision-makers refine pricing, streamline operations, and better align resource use with strategic priorities. In short, ABC turns data into actionable business intelligence.

The Value of Activity-Based Costing

The value of Activity-Based Costing (“ABC”) lies in its ability to provide precise and actionable insights into how resources are consumed across an organization. By linking costs directly to the activities that drive them, ABC enables businesses to understand the true cost of delivering products, services, or serving specific customers. This clarity helps identify which areas are profitable and which are underperforming or inefficient.

ABC is particularly valuable for companies with complex production processes that vary across offerings driving different resource usages. This differs from traditional costing methods that can’t factor in differences in production processes such as different sizes of batches. Having a greater gauge on cost drivers allows managers to make informed decisions about pricing, product mix, and process improvements by highlighting hidden costs and revealing inefficiencies. It also supports more accurate budgeting and forecasting by aligning cost data with actual operational activity.

Ultimately, ABC empowers organizations to optimize resource allocation, enhance profitability, and respond more effectively to changes in demand, cost structures, or market conditions. It transforms cost data from a backward-looking record into a forward-looking strategic tool.

How Activity-Based Costing Can Be Used to Adapt to Tariffs

Activity-Based Costing (“ABC”) models equip managers with the insights needed to make smarter, data-driven decisions in response to tariffs and other cost shocks. When tariffs raise input costs, ABC helps managers determine where and how those costs are actually incurred—by tracing them to specific products, services, and customer segments based on the activities they require. Three decisions managers can make included:

- Cost Pass-Through Strategy: In Cost Pass-Through decisions, ABC provides a greater level of detail needed to know where to target and by how much price should be raised. Rather than applying a blanket price increase, managers can use ABC data to selectively raise prices on products or customers that consume more tariff-affected resources, preserving competitiveness where margins are still healthy.

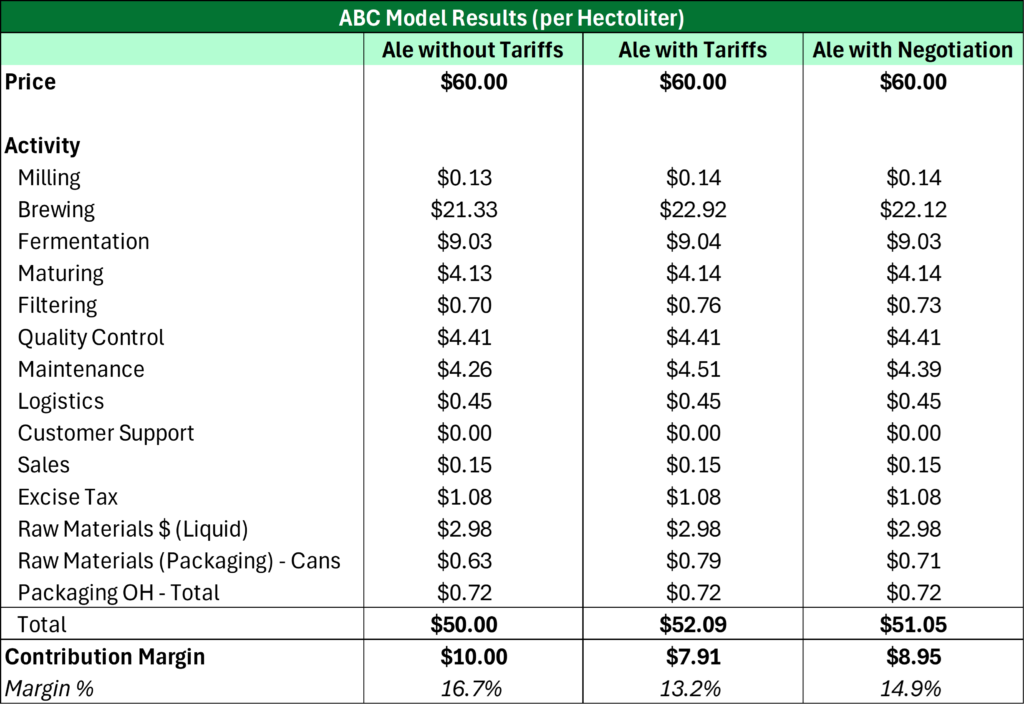

- Supplier Negotiations: In supplier negotiations, ABC highlights which inputs or services drive the highest indirect costs, providing the leverage to negotiate on more impactful items. It also identifies opportunities to shift sourcing strategies toward less cost-intensive alternatives.

Exhibit B: ABC Model Results (Supplier Negotiations)

- Product and Customer Mix Optimization: In product and customer mix optimization, ABC reveals which offerings are most affected by tariff-related costs and which remain profitable. Managers can use this to streamline product lines, discontinue unprofitable SKUs, or prioritize high-margin customers who are less sensitive to pricing changes.

In volatile environments, ABC transforms uncertainty into clarity—guiding managers toward more strategic, margin-preserving decisions in the face of rising and shifting costs.