How Outsourced PE Associates Strengthen Deal Execution and Value Creation

How Outsourced PE Associates Strengthen Deal Execution and Value Creation- February 5, 2026

- Thomas Xu

During recent years, lower interest rates during COVID have stimulated the buyout industry, leading to an increase in private capital investment. Investment analyses are typically conducted by private equity associates. On a typical day, a PE associate may review confidential information memorandums (CIMs) and...

ERP to Accounting System Reconciliation Automation

ERP to Accounting System Reconciliation Automation- January 2, 2026

A centralized, automated solution to reconcile revenues efficiently and provide reliable, actionable insights for finance and management teams.

Valuation Model and Estimate Report

Valuation Model and Estimate Report- December 29, 2025

A credible and defensible valuation to support a minority equity buyout in a wind farm operation, requiring enhancement of the forecast model and preparation of a DCF-based valuation report.

Optimizing IT Efficiency Through System Analysis

Optimizing IT Efficiency Through System Analysis- December 24, 2025

An assessment of software and resource usage to uncover inefficiencies and identify cost-saving opportunities.

The Data Strategy Behind Successful ERP Migrations

The Data Strategy Behind Successful ERP Migrations- December 19, 2025

- Wendi Chen

An ERP migration becomes necessary for a business to maintain operational efficiency when its current ERP system is unable to support its expansion, reporting requirements, or increasingly complex business. Migrating to modern ERP systems, such as Oracle Cloud ERP, NetSuite, or Microsoft Dynamics, requires...

Choosing the Right Cloud Platform for Your Business Intelligence Needs

Choosing the Right Cloud Platform for Your Business Intelligence Needs- November 15, 2025

In today’s hyper-competitive business environment, data-driven decision making is no longer optional. Organizations generate and consume massive volumes of data every day, and the ability to transform that data into actionable insights can make the difference between staying ahead or falling behind. This is where...

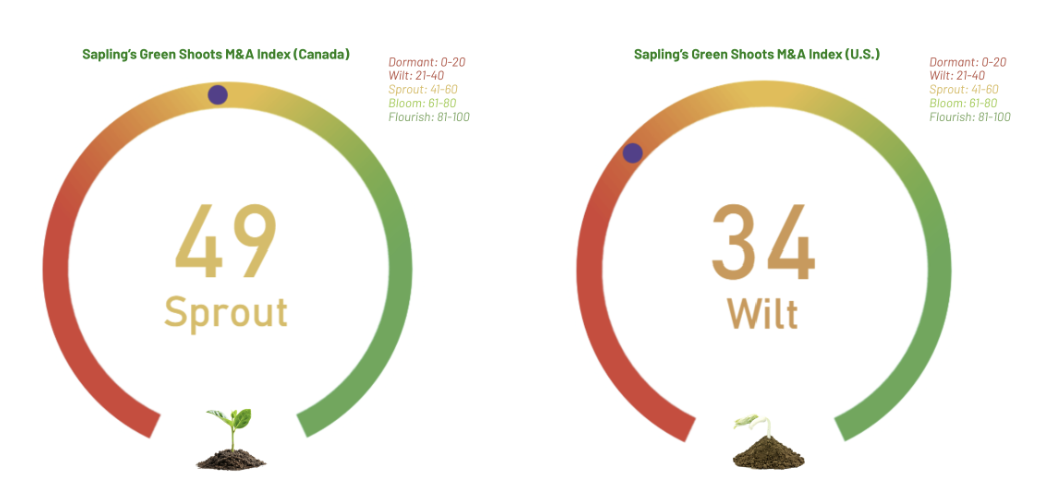

Sapling Financial Consultants’ Green Shoots M&A Index Reveals Diverging North American Trends

Sapling Financial Consultants’ Green Shoots M&A Index Reveals Diverging North American Trends- October 21, 2025

U.S. activity slows as Canada’s M&A market strengthens Atlanta, GA and Toronto, ON, October 21, 2025 — Sapling Financial Consultants released its October 2025 Green Shoots M&A Index for the U.S and Canada, offering a forward-looking view of North American M&A trends. The latest...

How Deferred Revenue Analysis Shapes M&A Transactions

How Deferred Revenue Analysis Shapes M&A Transactions- October 15, 2025

- Santiago Munera

Deferred revenue is a key consideration for companies operating through business models grounded in recurring revenues. Depending on contract terms, payments may be collected periodically or in lump sums. For companies that recognize annual renewals as revenue at the time of collection, deferred revenue...

The Post Pandemic New Norm – Hybrid Working and Performance Management

The Post Pandemic New Norm – Hybrid Working and Performance Management- September 25, 2025

- Morné Viljoen

The COVID-19 pandemic changed how businesses operate. Most companies shifted from full-time in-office to a hybrid work model, with some companies even adopting a fully remote work model. This “new normal” working environment has been maturing over the past few years, and it is...

IT Infrastructure Cost Optimization: Practical Strategies for Businesses

IT Infrastructure Cost Optimization: Practical Strategies for Businesses- August 18, 2025

Optimizing costs is essential for a company's financial stability and overall success. With the rapid advancement of technology, businesses now rely on a wide range of IT services to meet the needs of both customers and employees. These services include, but are not limited...

We deliver best-in-class financial consulting services so you can make better decisions for your business.

Bring your expertise to help businesses optimize their financial operations. We value passion, competence, and hard work, and offer a dynamic and challenging work environment that rewards creativity and innovation. If you’re looking for an opportunity to make a meaningful impact and grow your career, we’d love to hear from you.