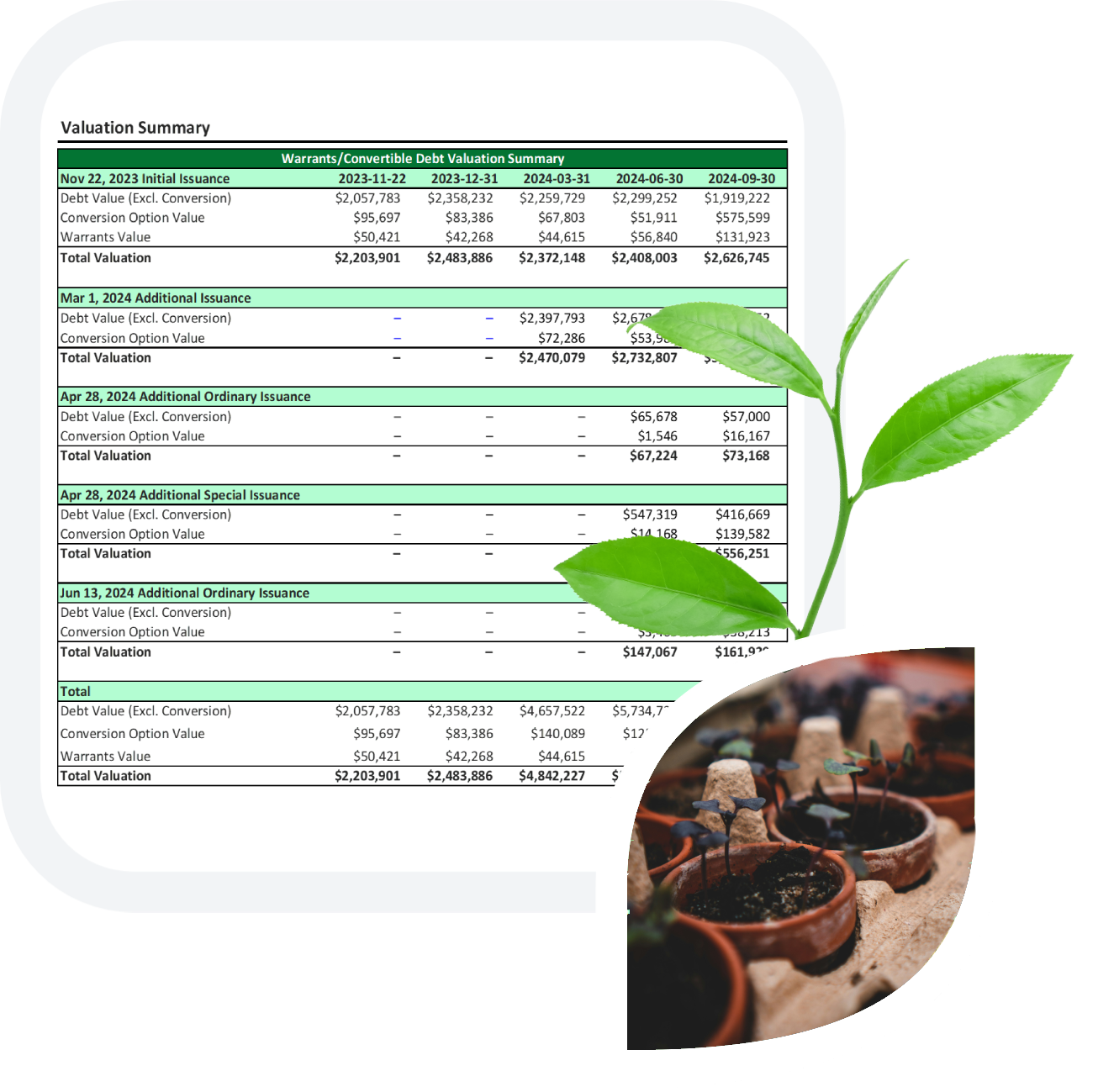

Financial Analysis – Valuations

Business valuations is the process of assessing a company’s worth using various methods, providing insights to support informed decision-making. A professional and independent valuation can be conducted for an entire company, a business segment, or specific assets.

Our Approach

Our services are designed to provide a comprehensive valuation that includes company background, scope of work, industry and economic analysis, valuation methodologies, key assumptions, and a well-supported conclusion of value.

- Comprehensive: conclusion of value, comprehensive review of business and industry, adequately corroborated, databook and detailed report

- Estimate: conclusion of value, limited review, analysis, and corroboration of relevant information, databook and light report

- Calculation: conclusion of value, minimal review and economic analysis, little to no corroboration, databook only

We collaborate closely with you to understand your business and financial objectives, delivering a comprehensive valuation that includes company background, scope of work, industry and economic analysis, valuation methodologies, key assumptions, and a well-supported conclusion of value.

Related Blog