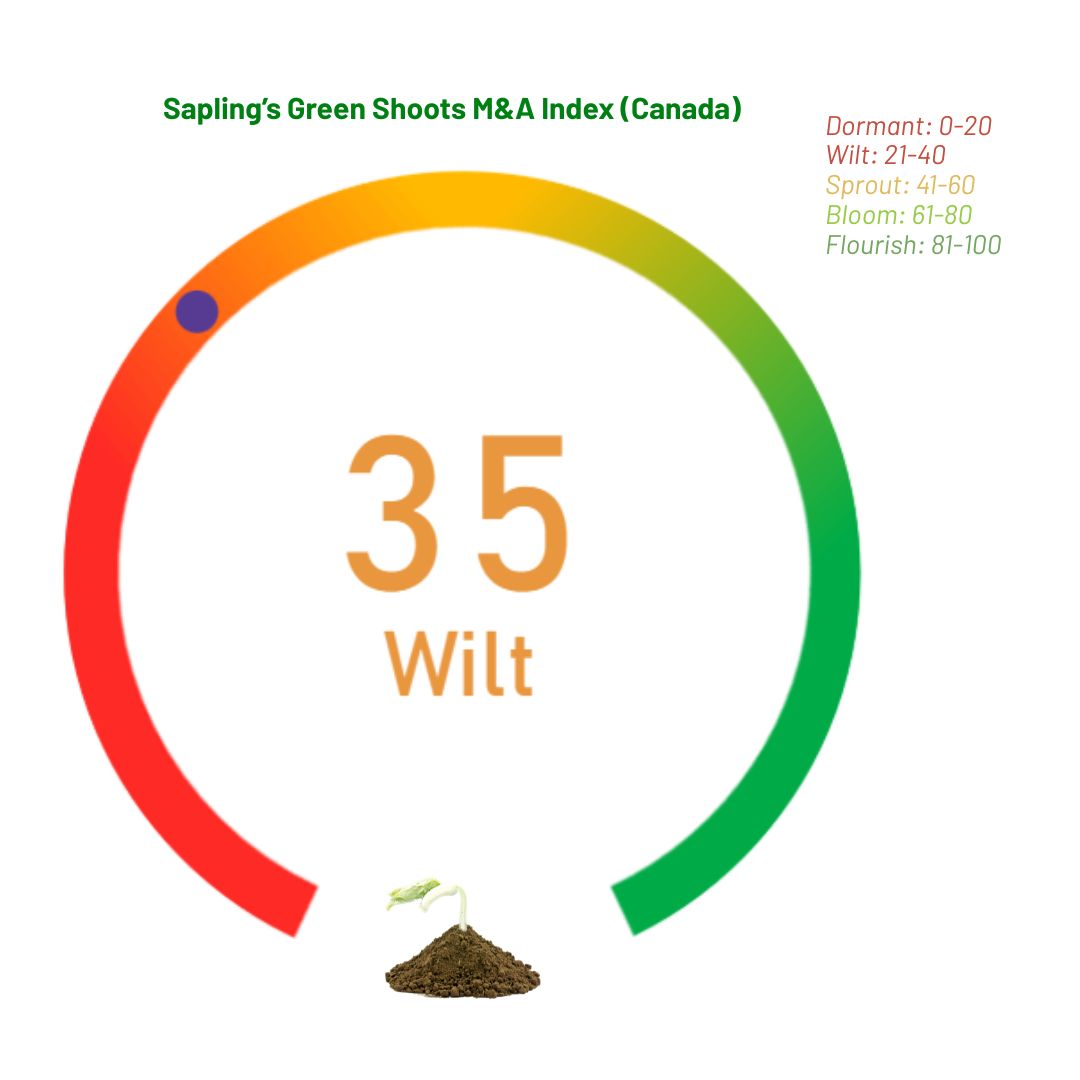

To capture shifts in market sentiment around mergers and acquisitions (M&A), Sapling created a monthly updated Green Shoots M&A Index. The index is built using both actual and predicted M&A deal numbers and is designed to reflect monthly market activity momentum. It tracks deal activity trends and provides a simple, intuitive signal of where Canada and U.S. M&A Deals Index Momentum might be heading.

Built using a robust machine learning Random Forest model, the Green Shoots M&A Index combines historical deal data with key market indicators. Updated monthly, the index captures the rate of change in M&A activity, offering insight into how the market is evolving and how it may react based on historical patterns.

Updated by: Wendi Chen; Last update: 2025/1/16

Canada

U.S.

How to Read?

To make the index easy to interpret, we normalized the monthly changes to a fixed scale of 0 to 100, using a Min-Max scaling method. Each stage reflects the prevailing level of M&A activity:

- Dormant (0-20): Phones are quiet. Boardrooms are still. The market is on pause, and activity has all but vanished.

- Wilt (21-40): Deals are inching forward, stuck in sluggish due diligence. Everyone’s cautious—no one wants to make the first move.

- Sprout (41-60): Pitch decks are floating around, conversations are picking up, but dealmakers are still hesitant to pull the trigger.

- Bloom (61-80): Valuations are stabilizing, acquirers are active, and term sheets are coming out of hibernation.

- Flourish (81-100): A surge in activity. Deals are closing fast, and the market is buzzing with momentum.