CLIENT: Private Equity Group

A private equity group was looking to purchase a mid-tier mining company financed with a combination of debt, equity and a streaming facility, and then merge it with another company in an all-stock deal to create a diversified producer. The total deal approached $1B

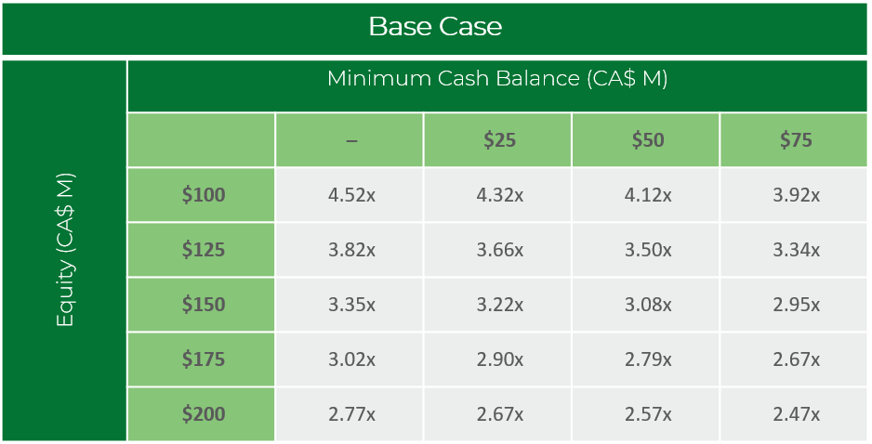

EQUITY INVESTOR RETURN MATRIX

Latest Case Studies