CLIENT: Private Equity Firm

A private equity firm specializing in food companies and the agricultural sector approached Sapling for assistance on a few ongoing projects. The client had existing detailed operational based models for a few potential companies they were looking to invest in and were looking for Sapling to layer in cash flow calculations, IRR and return metrics, and various scenarios and sensitivity analysis to assess the deal without creating a brand-new model

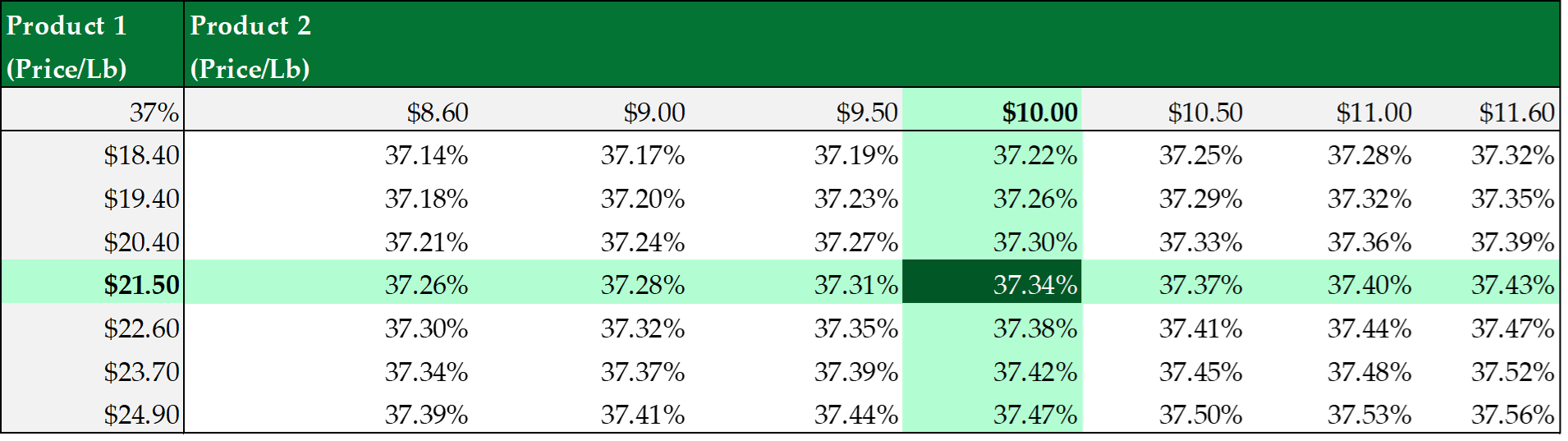

EXAMPLE: IRR SENSITIVITY ANALYSIS OF PRICING

Latest Case Studies