CLIENT: Publicly-Traded Industrials Company

The company was looking to expand their operations through the strategic purchase of a US-based entity with a price range of US$20-60M. Key to making the deal work and raising mezzanine debt financing was determining the right price without overpaying. They engaged Sapling to assist with the due diligence process

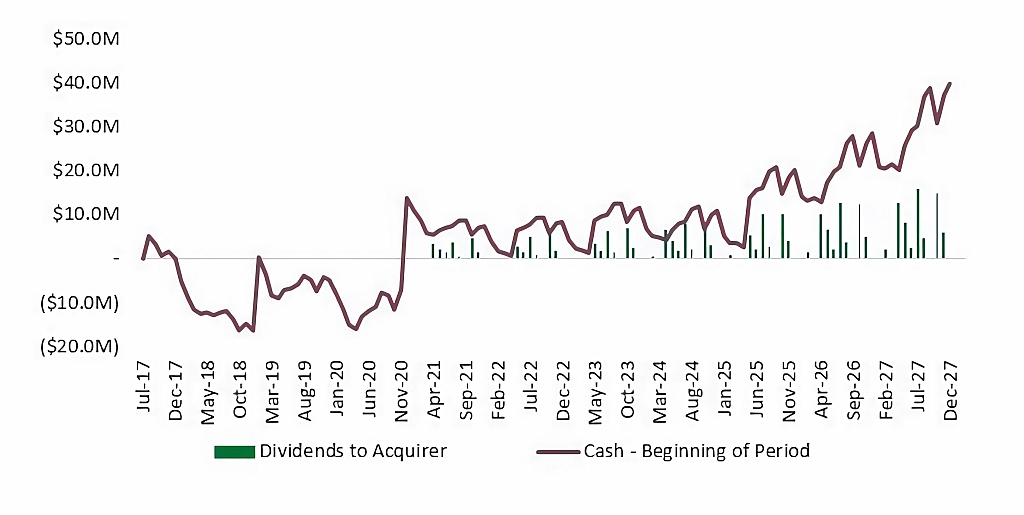

TARGET NET CASH VS DIVIDENDS TO ACQUIRER

Latest Case Studies