CLIENT: Public Healthcare Support Intermediary

A company working as intermediary for various government driven healthcare initiatives approached Sapling to assist them with setting up a costing model that would help them allocate their direct and overhead costs to appropriate projects for better insight on their project profitability

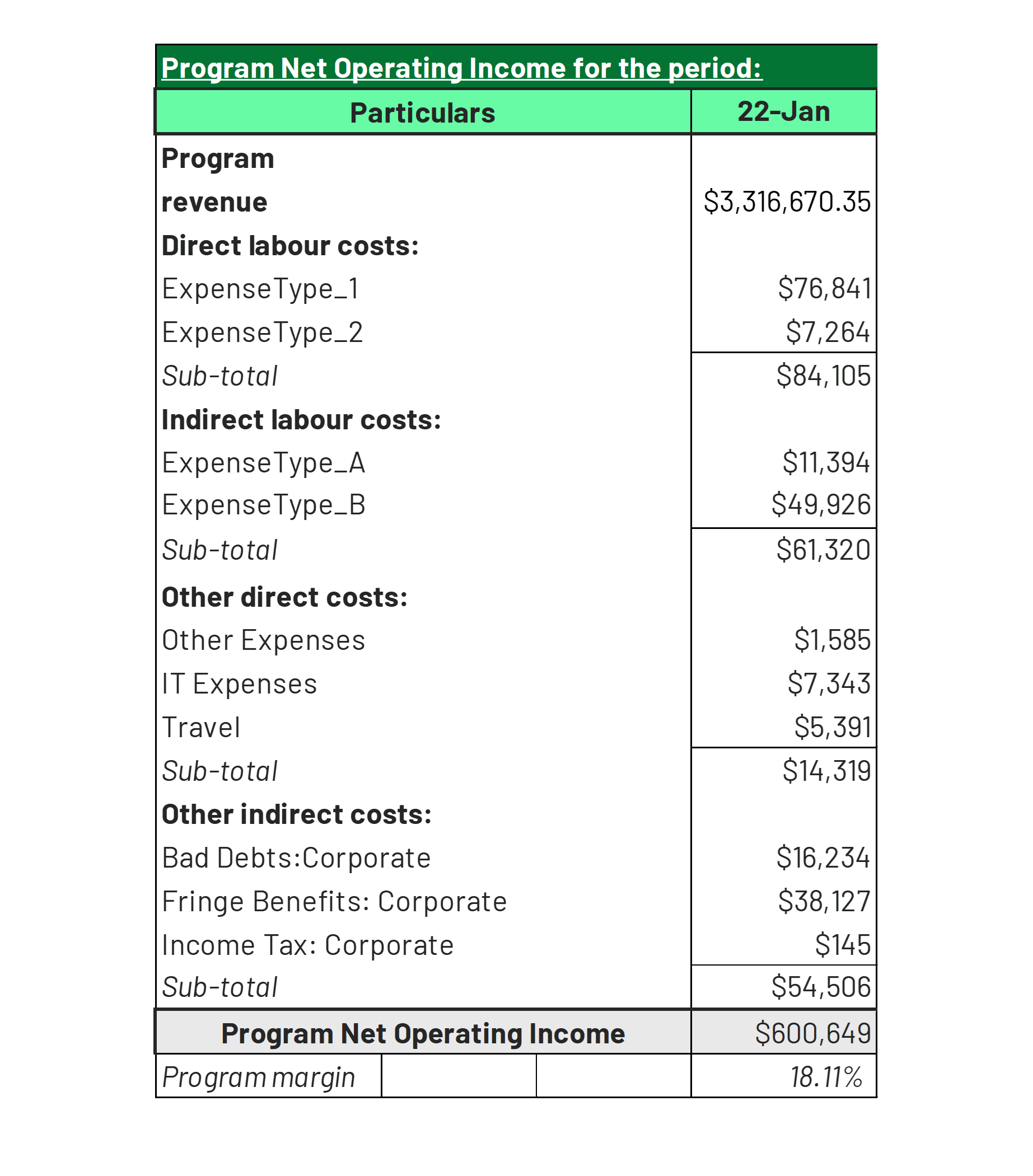

NET OPERATING INCOME MARGINS - BY PROGRAMS

Latest Case Studies