CLIENT: Investment Firm

A credible and defensible valuation to support a minority equity buyout in a wind farm operation, requiring enhancement of the forecast model and preparation of a DCF-based valuation report.

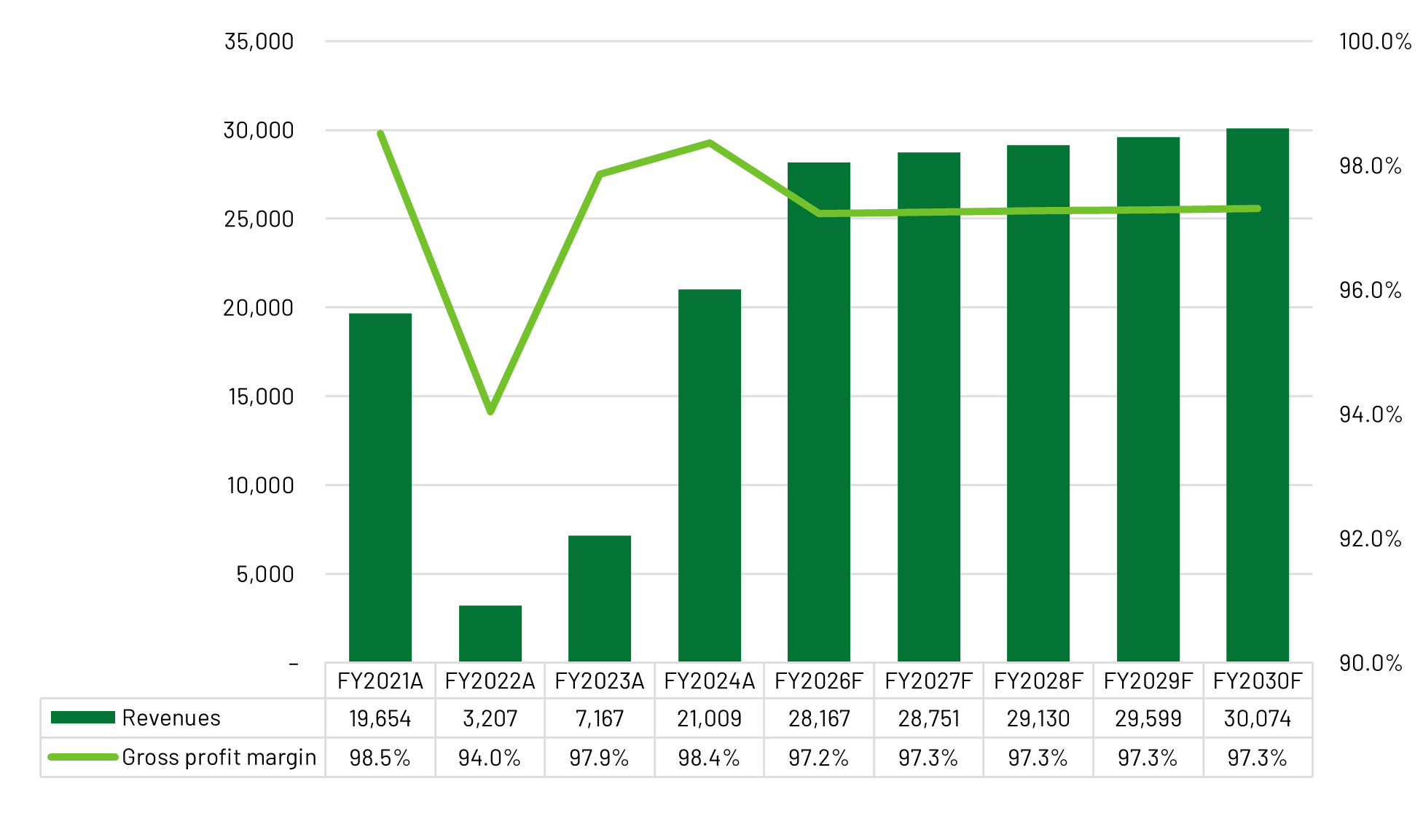

Historical and Forecasted Revenues and Gross Profit Margin

Latest Case Studies