CLIENT: Private Equity Firm

A private equity firm based in the US contacted Sapling to generate a custom LBO model template, which could be reused over the course of a few years. Given the small size of the firm, the company wanted the model so they did not have to spend critical time customizing prior models or creating models from scratch, and could instead deploy an LBO template already available in a fast and accurate manner.

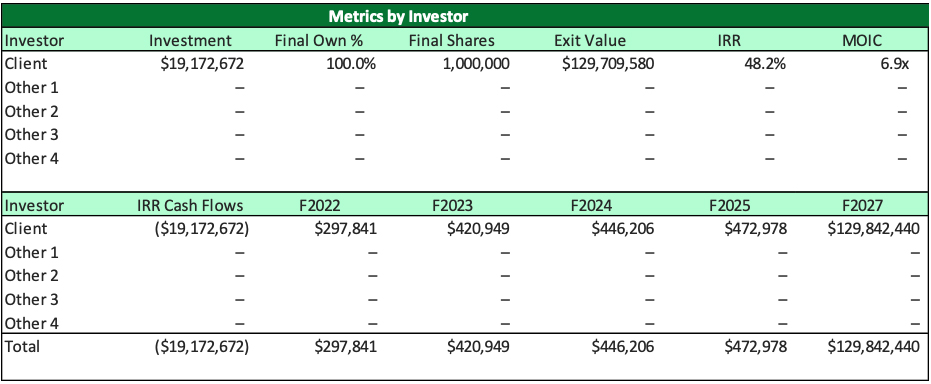

EXAMPLE: Metrics by Investor

Latest Case Studies