CLIENT: A Logistics Automation Company

Sapling was engaged by an automated material-handling technology company, as part of a search fund acquisition process, to conduct a QoE analysis ahead of a potential acquisition. The work validated historical earnings, assessed recurring revenue quality, and identified key financial drivers critical for valuation and investment decisions.

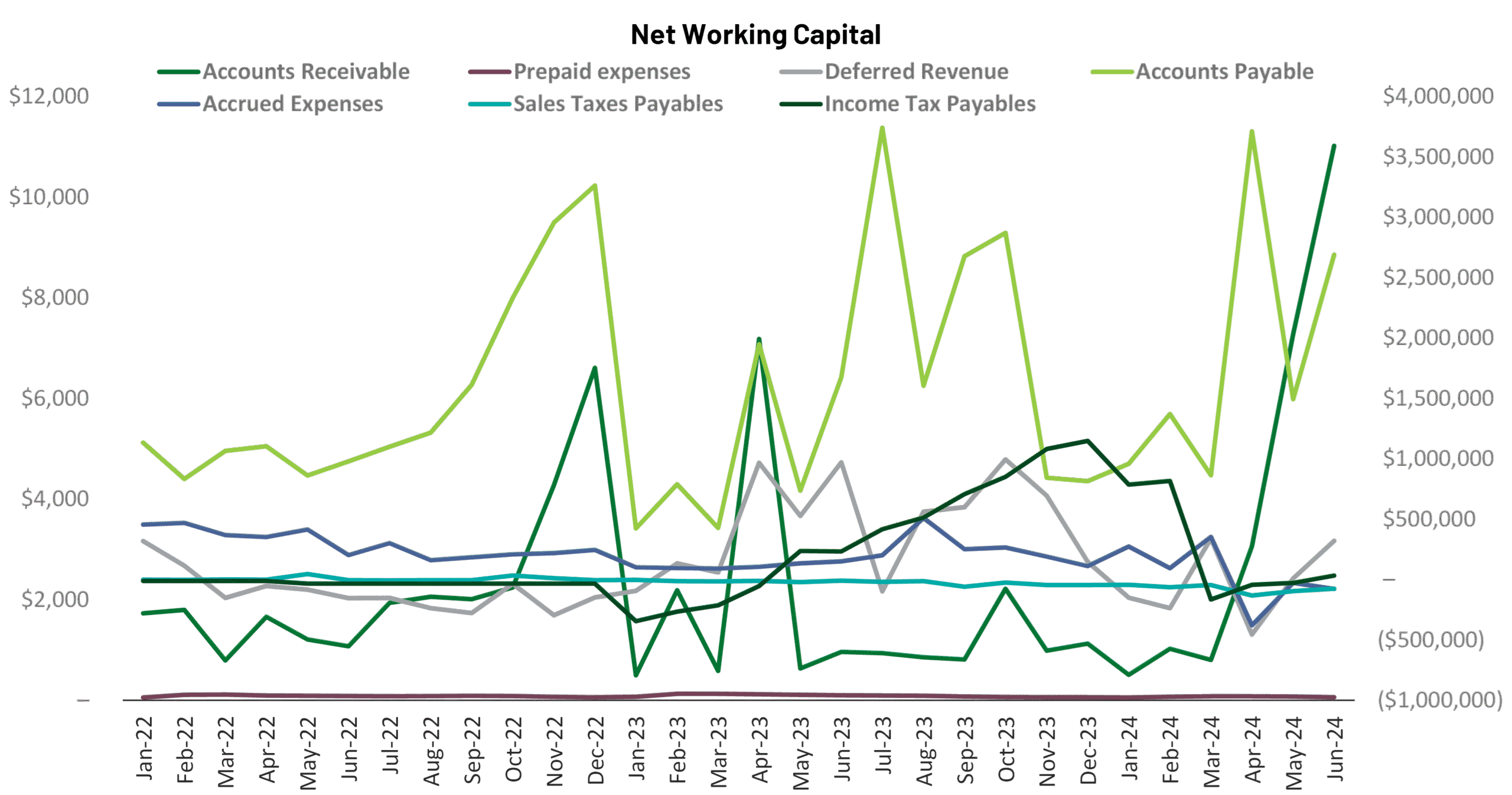

Adjusted Net Working Capital

Latest Case Studies