CLIENT: Investment Firm

An investment firm based in Canada was looking to upgrade their existing spreadsheets that they used for calculating key portfolio return metrics, as it was currently very manual intensive and had a high potential for human error. The firm approached Sapling to develop a streamlined tool to replace their existing one, which could be used for the next 10 years

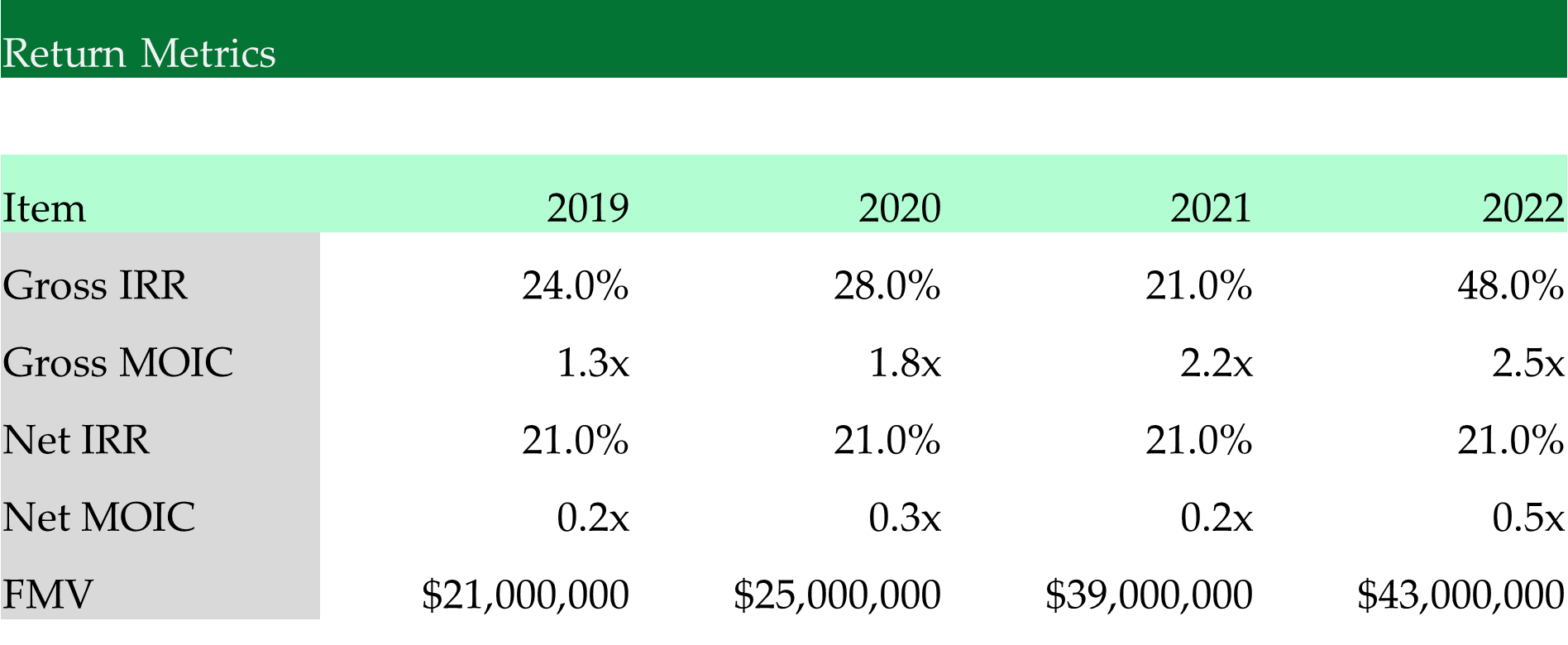

EXAMPLE: RETURN METRICS BY YEAR

Latest Case Studies