CLIENT: Agricultural Company

A sustainable food and agricultural company in North America had previously engaged Sapling to develop an in-depth financial model outlining the operational and return metrics of opening a new farm. Following this, Sapling was re-engaged to build a Monte Carlo (MC) model simulating the return and probability of different strike prices for warrants that the client had purchased

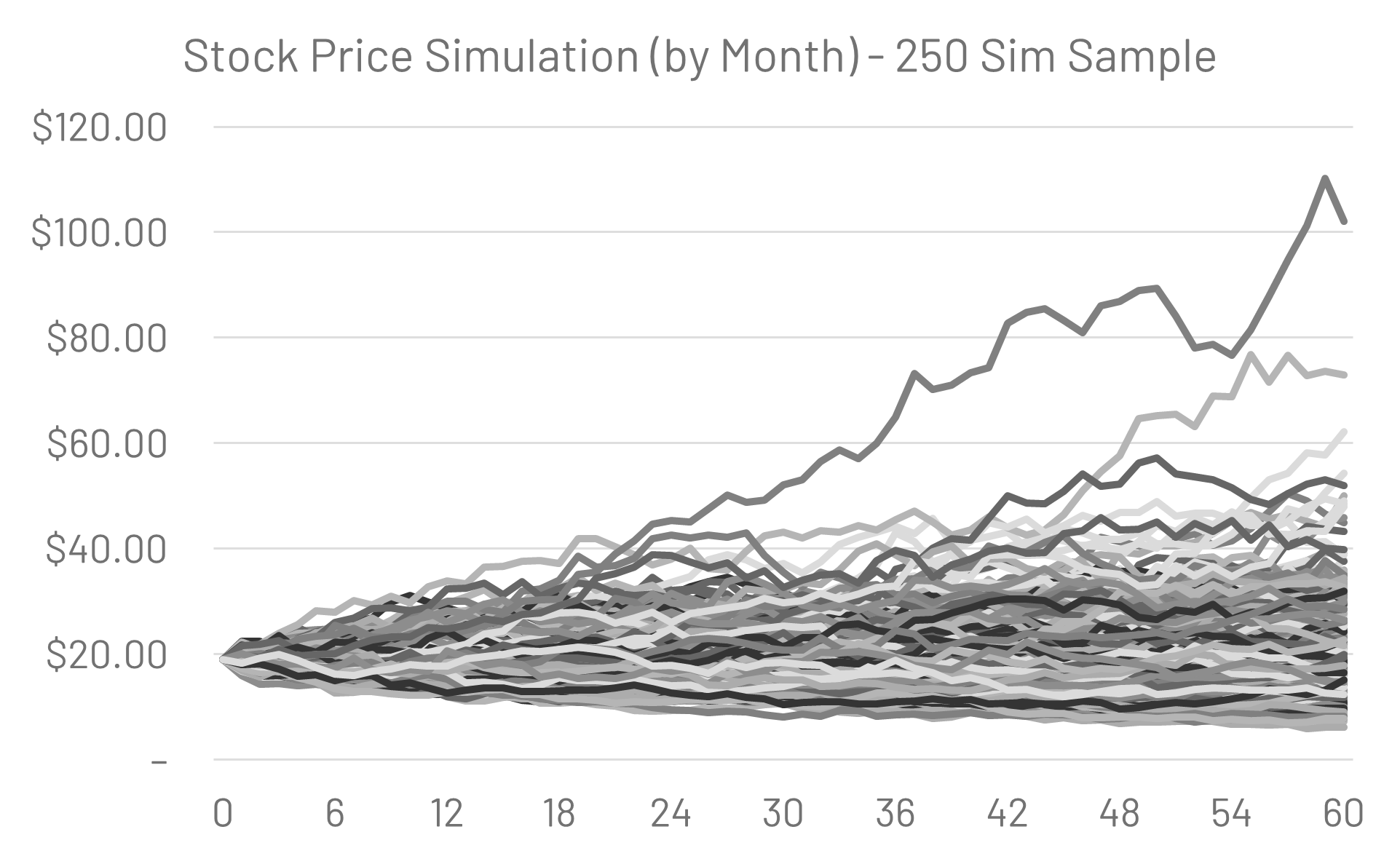

EXAMPLE: 250 SIMULATION PLOT (BY MONTH)

Latest Case Studies