CLIENT: Sustainability And Emissions Consultant

A company growing rapidly through the combination of organic growth and acquisitions engaged Sapling to develop a financial model that could be used to show to potential investors, as well as evaluate requirements needed to finance new acquisitions

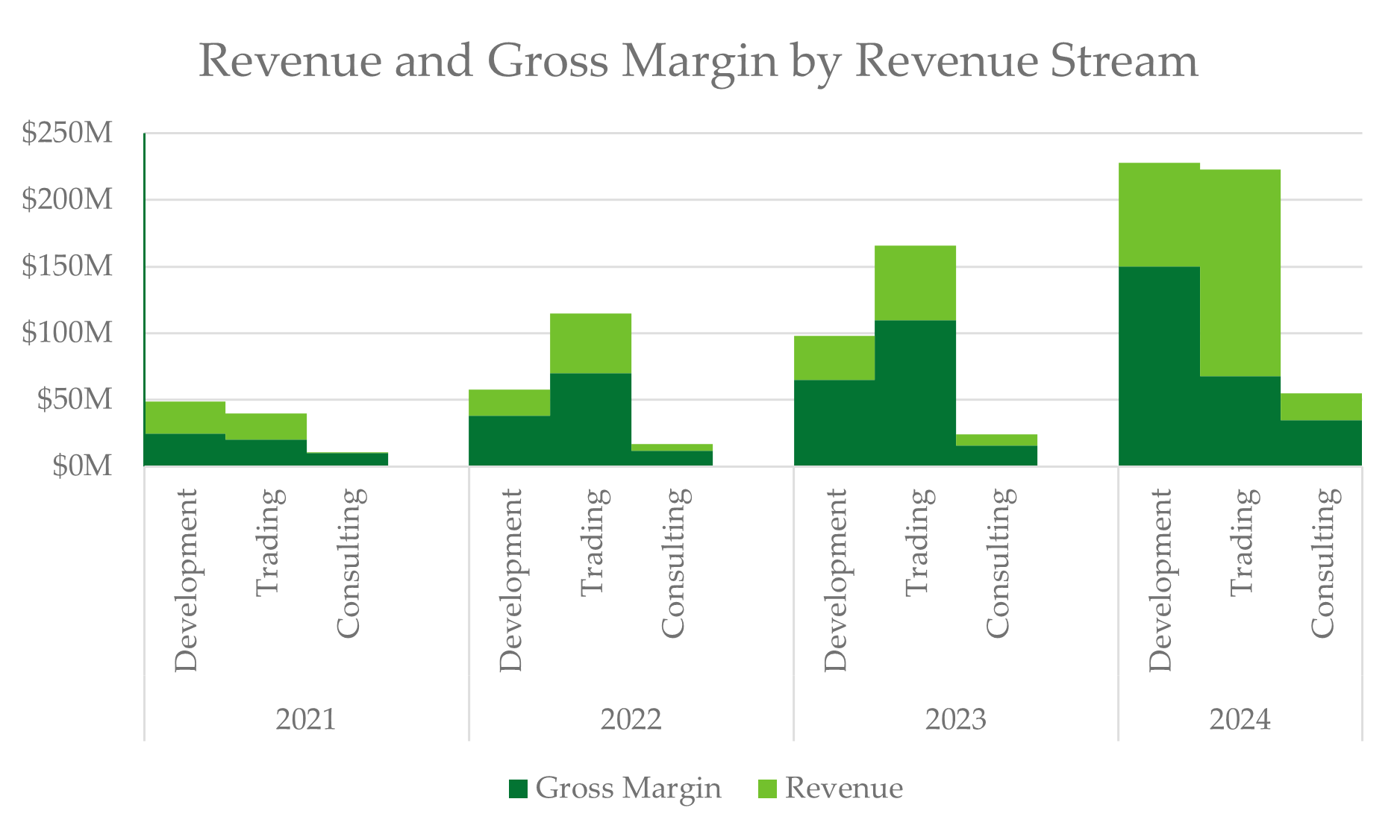

REVENUE AND GROSS MARGIN BY REVENUE STREAM

Latest Case Studies