CLIENT: FinTech Company

A large Canada-based fintech company approached Sapling to build a customized M&A model for the acquisition of three smaller UK-based fintech entities. The model includes various revenue and cost factors, unique to each target entity. The requirement was to build an integrated model, having GBP and CAD values, with 5-year forecasts to analyze the exit valuations and NPVs for each of the entities, as well as a consolidated valuations for the client

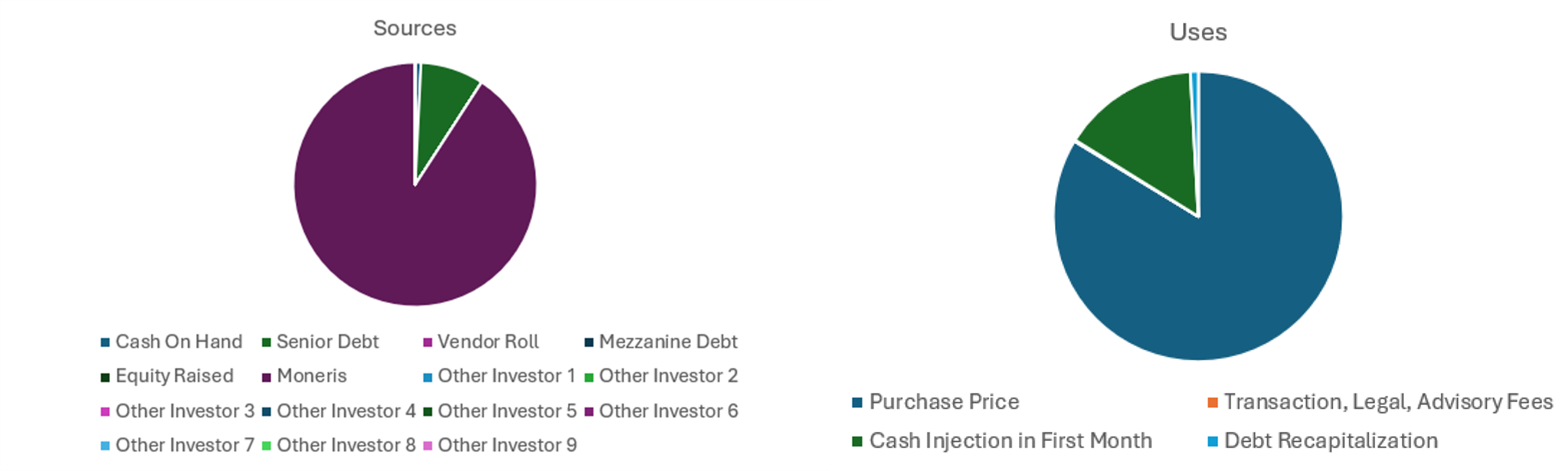

FinTech M&A Model

Latest Case Studies