CLIENT: Electricity Transmission Operator

An electricity transmission operator is launching a new project that will require a significant capex to move electricity from a low-cost to a high-cost jurisdiction. They approached Sapling to build a financial model to assist with (a) pricing the transmission, and (b) obtaining financing

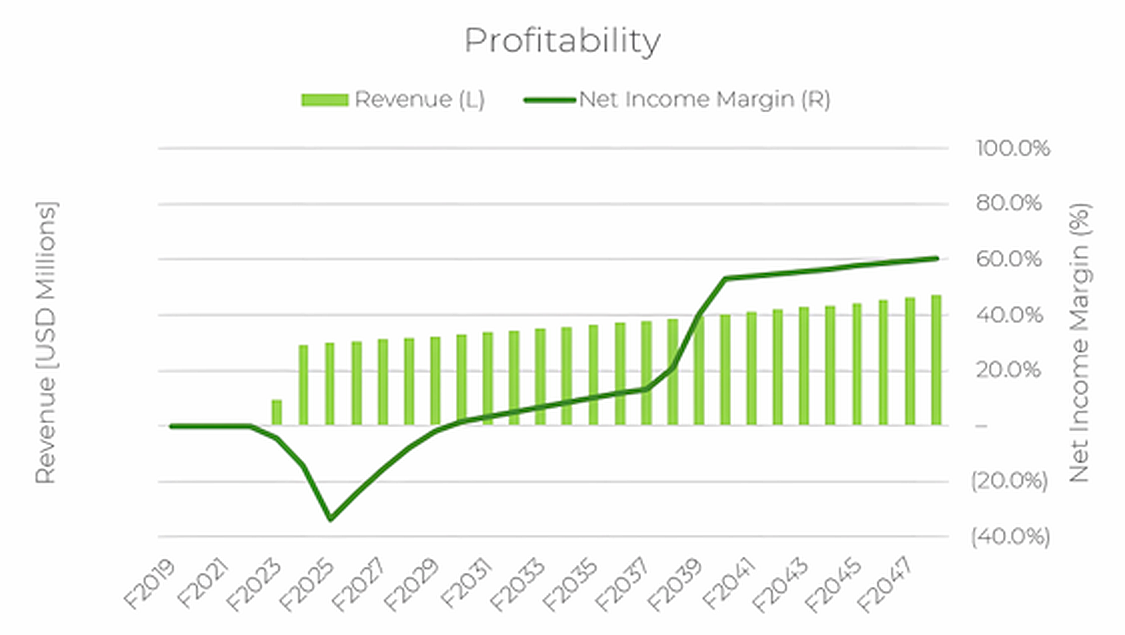

PROJECT PROFITABILITY OVER TIME

Latest Case Studies